A bored mind can wander and wonder.

NVIDIA is a chip company, but does CUDA and 'locking' effects make it an OS for accelerated computing?

Also, cash spewing tech companies needed to put their cash to use; the NVIDIA GPUs is a great forced bet for so many of these companies.

Funnily, that doesnt mean its a good investment by the hyperscalers or newbies ; nor does it mean that NVIDIA cant go to $10 T from the curent $3.5 T

_______

Google had a search/ advtg monopoly; along came FB and took away a good chunk via the website facebook.com

And then, the app culture, has taken away more of Google's business.

And now, will chatgpt-esque competition change the nature of search? But does Youtube stay intact?

Also - have you noticed how whatsapp is now the primary 'mailing' app for personal, B2C and small businesses? I know people who kind of dont see their emails anymore.

______

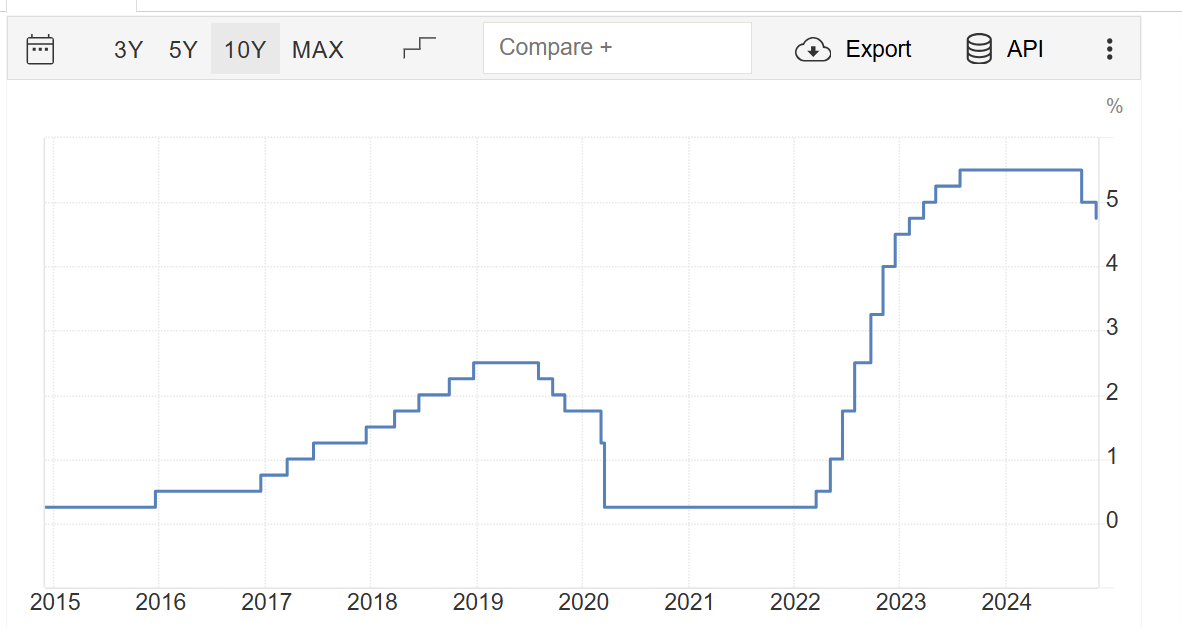

Why did the Fed reduce the overnight rate target from 5.5% to 4.75% (4.5-4.75) in the last 60 days?

Was it an egoistic imperative to have a 'soft landing'? Because there didnt seem like any reason:

"The Federal Reserve's mandate, also known as its dual mandate, is to promote maximum employment, stable prices, and moderate long-term interest rates".

None of these seem to have been triggered.

_____

I have a folder going back to 2011 chronicling the building China bubble, and the logical fallacy of capex/ infra spending and genuine growth. I kept making new folders for every year.

And after 10+ years of everyone praising the growth model, it looks like there were no clothes.

It's a good lesson in the gumption and humility in seeing the truth.

Similarly, what I see today is:

Below is the Fed Funds rate;

And it reminds me of an Icahn anecdote: "Boom, boom boom, and I fired those people, emptied the whole building, but not a whine... its like those people had never existed."

From 2022 to 2024; nothing monumentally negative has happened; with rising rates, there were no crazy commercial defaults, gold kept going up, Bitcoin kept going up, stocks up, no spike in junk bond defaults.

It feels like China.

And my sense is that Private funds have a lot to do with this; there is a chance that they have evergreened some assets/ loans; that the ETFization of Bitcoin has had consequences, and the underlying defaults of these private funds are hidden because of steady growth (similar to how high bank asset growth can hide default rates because of base effects)

"Private

markets assets under management totaled

$13.1 trillion as of June 30, 2023, and have grown

nearly 20 percent per annum since 2018."

I guess I am a skeptic at heart who believes that there is no free lunch.

And Reflexivity says that so many years of (since 2008 almost) continuous rise in asset prices has dulled rationality.

'Stocks tend to go up', 'gold tends to go up', 'crypto is the future'. These maxims have taken a strong hold, not only in the US; but more so in Japan and India too.

I wonder what Turkish, Sri Lankan, Chinese, South Americans, Ukrainians etc are saying to these things.

My conclusion is: We are precariously poised. Similar to 2006-2007 where the world was oblivious to the tail of CDS and CDOs wagging the dog of the economy; and when the tail got infected, the dog could not do much...

The music is playing and we are dancing.

______

And dont get me started on what the political effects of a recession of world leading economy could be. One spark is all that is needed.

Addendum: History shows that pegs dont tend to last. Wondering if there will be a cataclysmic 7.19 going to 10 someday soon.

_______

Boredom is a wonderful thing.